Digital Training Solutions for the Financial Sector

Tailored Training Solutions for Regulatory Compliance

In the financial industry, where data protection and compliance are central, a targeted training strategy is essential. Banks and financial institutions operate in a highly regulated environment with stringent security standards, making it crucial to provide ongoing training that meets these requirements

TCmanager® is a Learning Management System (LMS) designed specifically to address needs, such as are typical in the banking sector. It combines powerful security features, flexible learning options, and precise reporting tools, all aimed at meeting regulatory requirements and minimizing risk.

With its combination of advanced LMS capabilities and customizable, specific modules, TCmanager® provides banks with a centralized platform for effective employee training that can easily adapt to regulatory changes.

Challenges and Requirements in the Financial Sector

In the financial sector, training management and compliance tracking are highly demanding and complex, as banks and financial institutions must continuously train employees on regulatory updates, data protection, and security.

High Security & Compliance Tracking

Financial institutions must ensure that all compliance requirements are met and documented at all times. TCmanager® supports this by offering:

- Data Protection and Security: Sensitive customer and financial data are subject to stringent security measures, requiring advanced encryption, access controls, and secure authentication. TCmanager® uses the latest security technologies to meet these high standards.

- Regulatory Compliance Tracking: TCmanager® allows seamless tracking of compliance processes, specifically aligned with the needs of regulatory bodies like BaFin and the Deutsche Bundesbank. The platform automatically records who has completed which training, along with individual progress tracking.

- Automated Notifications: A flexible notification system ensures that all compliance-related training and updates are completed on time. Both employees and managers receive automated reminders about upcoming or overdue training sessions.

Adaptive Learning

In a dynamic industry like finance, where regulations change frequently, flexible and personalized learning is essential:

- Tailored to Individual Knowledge Levels: TCmanager® provides adaptive learning paths, tailoring content to each employee's knowledge level and role requirements. This ensures employees are neither overwhelmed nor under-challenged.

- Risk Minimization Through Targeted Content: Compliance errors pose high risks; TCmanager® mitigates this by tailoring training content to ensure maximum accuracy and risk prevention.

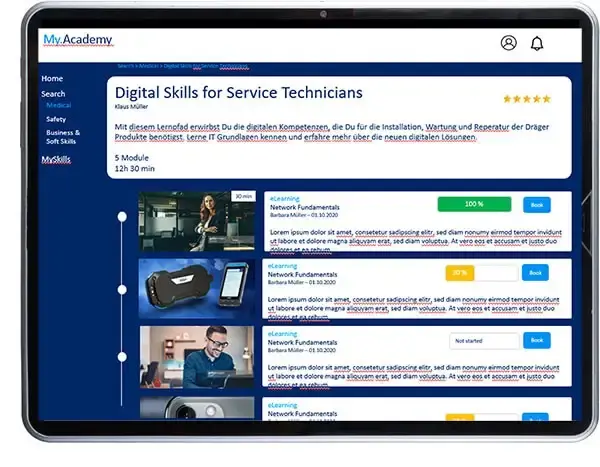

- Flexibility Through TCmanager® LXP: The LXP (Learning Experience Platform) module is an extension of TCmanager® that enables personalized, flexible learning paths, specifically designed for the financial sector's needs. Learning content adapts dynamically to both the learner’s progress and the latest regulatory changes.

Training Program

Training Program

TCmanager®: Tailored Features for the Financial Sector

TCmanager® offers a broad range of features specifically designed to meet the complex requirements of the financial industry. From data protection to transparent reporting, banks and financial institutions have all the tools they need for effective training management.

Data Security and Compliance

TCmanager® guarantees data security through state-of-the-art standards seamlessly integrated into the platform.

- Encryption and Access Controls: The platform uses advanced encryption and access management systems, ensuring only authorized individuals access sensitive data. For the financial industry, where data protection is a top priority, this provides a high level of security.

- Audit Trail: All platform activities are recorded, allowing precise monitoring and traceability of changes and training progress. This is especially important for banks undergoing both internal and external audits.

- Regulatory Compliance Processes: The platform is designed to meet BaFin and Deutsche Bundesbank requirements, including documentation and archiving standards.

Adaptive Learning and TCmanager® LXP Module

Adaptive learning offers the flexibility demanded in the financial sector.

-

- Personalized Learning Paths: TCmanager® LXP dynamically adjusts learning content based on employee progress and individual needs, providing significant added value, particularly in compliance training.

- Risk Optimization: By tailoring training to specific needs, potential sources of error are minimized. The system ensures relevant content is reinforced and repeated if needed until complete understanding is achieved.

- Efficient Knowledge Delivery: Adaptive learning saves time by delivering precisely the content needed for each employee's role and knowledge level, optimizing the use of learning resources.

Detailed Reporting and Audit Capability

TCmanager® offers comprehensive reporting and documentation options specifically tailored to the financial sector’s requirements.

-

-

- Detailed Progress Reports: Banks can access employee training progress at any time and conduct targeted analyses for compliance audits and internal controls.

- Automated and Customizable Reports: The platform provides compliance report templates that can be customized as needed, increasing transparency and accountability in training.

- Audit-Proof Documentation: TCmanager® ensures complete traceability of all training activities, facilitating the preparation and execution of internal and external audits while minimizing compliance-related risks.

TCmanager® in Action: Benefits for Banks and Financial Institutions

Implementing TCmanager® brings significant efficiency and security benefits to banks and financial institutions. The platform is designed to simplify complex training processes while meeting the highest standards.

Personalized Learning Path

Personalized Learning Path

Efficient Training and Time Savings

TCmanager® enables centralized management and automation of numerous training processes.

- Individualized Learning Paths: Employees receive only the training they need based on their knowledge level and regulatory requirements, ensuring efficient use of learning time.

- Quick Adaptation to Regulatory Changes: New requirements or content can easily be integrated into existing training courses, ensuring employees are always up-to-date.

- Automated Notifications: Reminders for training deadlines and compliance requirements are automatically sent, ensuring timely completion.

Reduced Compliance Team Workload

TCmanager® handles the monitoring and documentation of training activities, easing the workload of compliance teams.

- Automated Certificate Verification: The platform automatically verifies and archives certificates and participation records, relieving the compliance team of this administrative task.

- Transparent Progress Tracking: Administrators and compliance managers can access learning progress at any time to see who has completed their training.

Support for Employee Development and Risk Minimization

TCmanager® helps financial institutions continuously and effectively develop their employees’ skills.

- Targeted Risk Mitigation: By customizing training to specific employee requirements, compliance violations are minimized.

- Enhanced Employee Competence: Continuous learning ensures that employees are well-informed and capable, contributing to safe and competent operational practices.

Checklist for Financial Institutions: LMS Requirements

This checklist helps financial institutions assess LMS requirements for their specific needs:

- Security Standards and Compliance

- Does the LMS meet stringent data protection and security standards set by regulatory authorities?

- Are all data secured with current encryption and access protection measures?

- Adaptive Learning and Personalization

- Does the LMS offer adaptive learning paths that consider employees’ knowledge levels and regulatory requirements?

- Can the system provide targeted content to reduce potential compliance risks?

- Reporting and Audit Capability

- Does the LMS enable detailed reporting for tracking training and compliance activities?

- Does it support the creation and customization of reports for internal and external audits?

- User-Friendliness and Employee Acceptance

- Is the user interface intuitive and easy to navigate?

- Does the system allow employees to access training from various devices?

- Expandability and Flexibility

- Does the LMS offer additional modules, such as TCmanager® LXP, for adaptive learning and skill development?

- Can the system be easily adapted to new regulatory requirements?

Contact and Further Information

Interested in learning more? Our experts are available to discuss how TCmanager® can support your organization’s compliance and training needs, and to offer a demo of the platform. Discover how TCmanager® can become your comprehensive solution for training and qualification management.

Experience for yourself how TCmanager® Seminar Management Software revolutionizes your seminar planning! Schedule a personal consultation now and request a free demo to discover how you can plan your seminars more efficiently and economically with TCmanager®.

About Us

Since 1998 SoftDeCC is working closely with major training centers and academies. This results in a unique experience with training requirements.

Our Learning Management System TCmanager® is designed to adjust to individual corporate learning processes and address evolving challenges. More...

Free Consultancy

Discuss your Training Challenge with us.

Call +49 (0)89 / 309083930 to arrange for your free consultancy.

.webp)